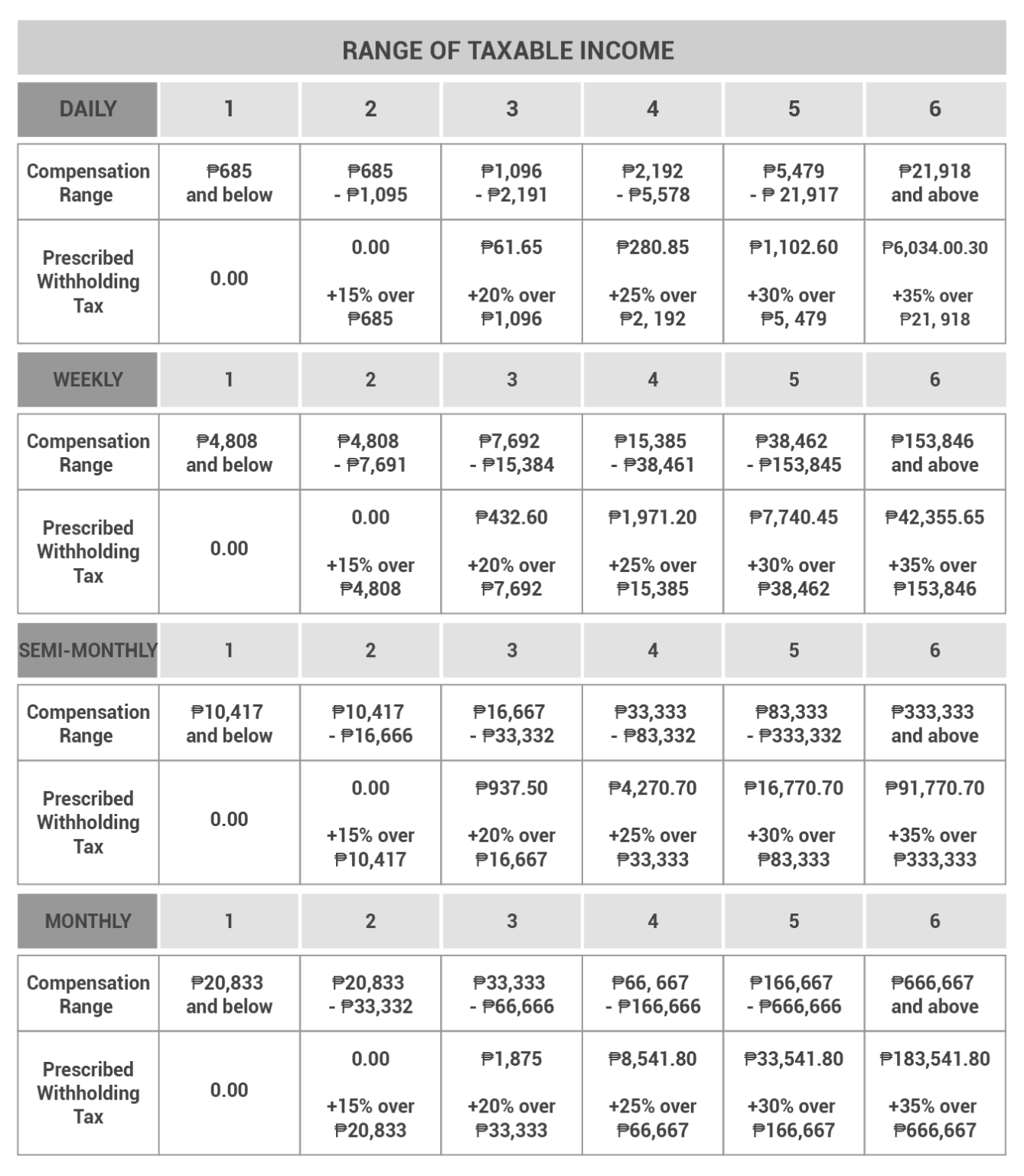

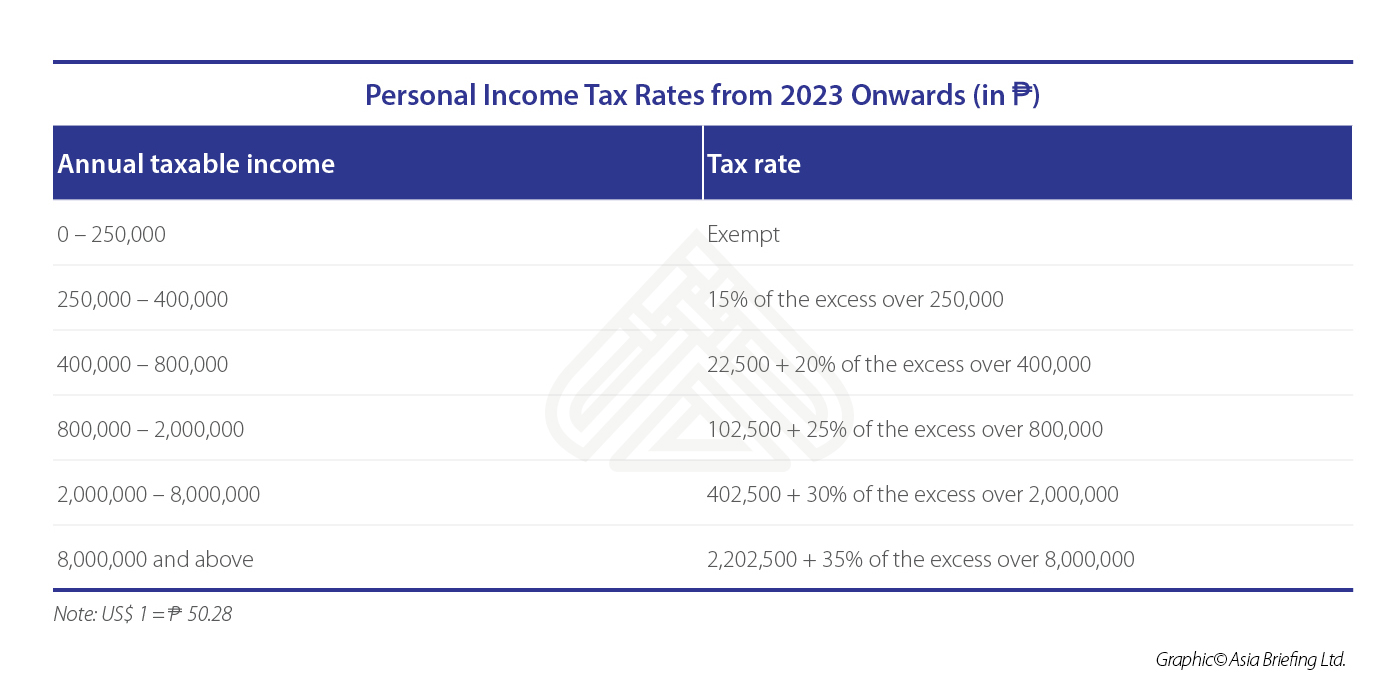

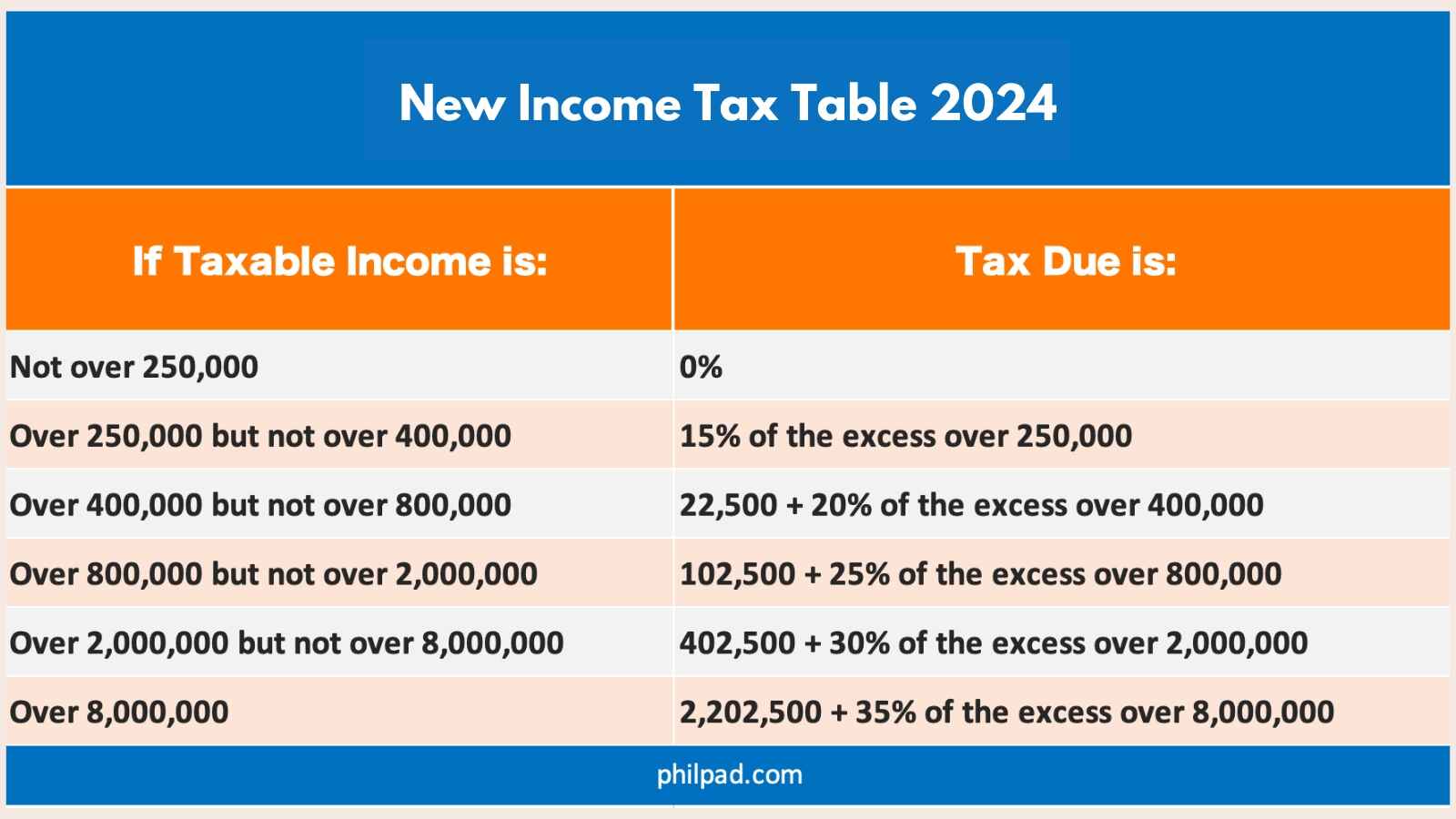

Philippine Tax Brackets 2025. Tax season, perhaps america’s least favorite pastime, is well underway. This page contains the tax table information used for the calculation of tax and payroll deductions in philippines in 2025. From the new tax table 2025 above, we got a sample following income computations.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. These tax tables are used for the tax and payroll.

How to compute tax in the Philippines, This tool is designed for simplicity and ease of use, focusing solely on.

The Philippines’ New Tax Reform Package Approved Vinh Le IR Global, Philippines residents income tax tables in 2025.

UPDATED Tax Tables in the Philippines and TRAIN Sample, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Tax Calculator Philippines 2025, Personal income tax rate in philippines averaged 32.90 percent from 2004 until 2025, reaching an all time.

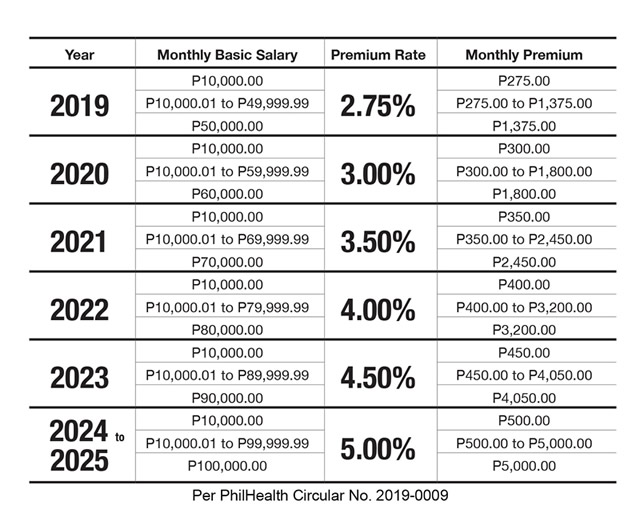

PhilHealth Contribution Table for Employees and Employers, The philippines tax calculator below is for the 2025 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions.

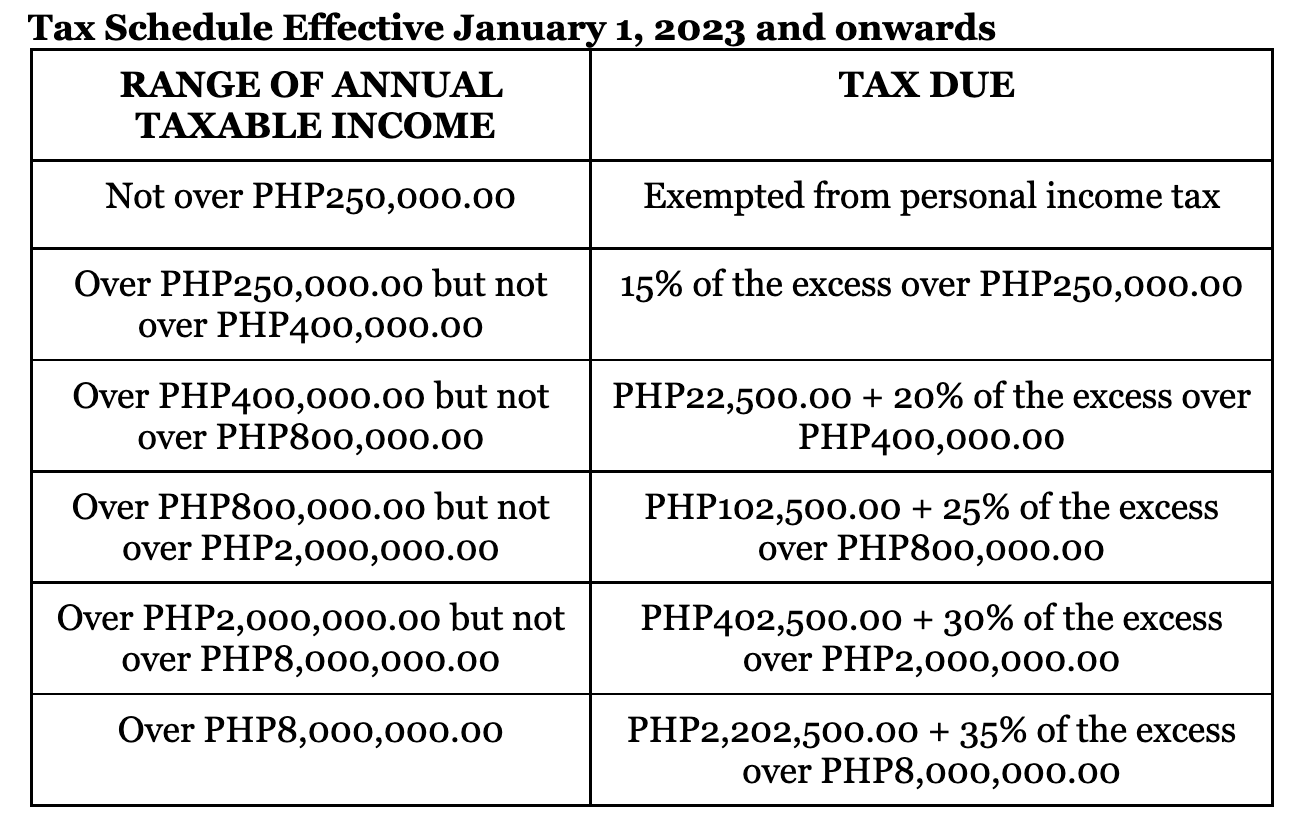

BIR Tax Schedule Effective January 1 2025, The federal income tax has seven tax rates in 2025:

Philippine Personal Tax Rates (2018) Ines Gopez Amarante and Co., Income tax calculator sample for 2025.

Tax, SSS, and PHIC Updates for 2025 InCorp Philippines, Determine your gross sales or receipts.

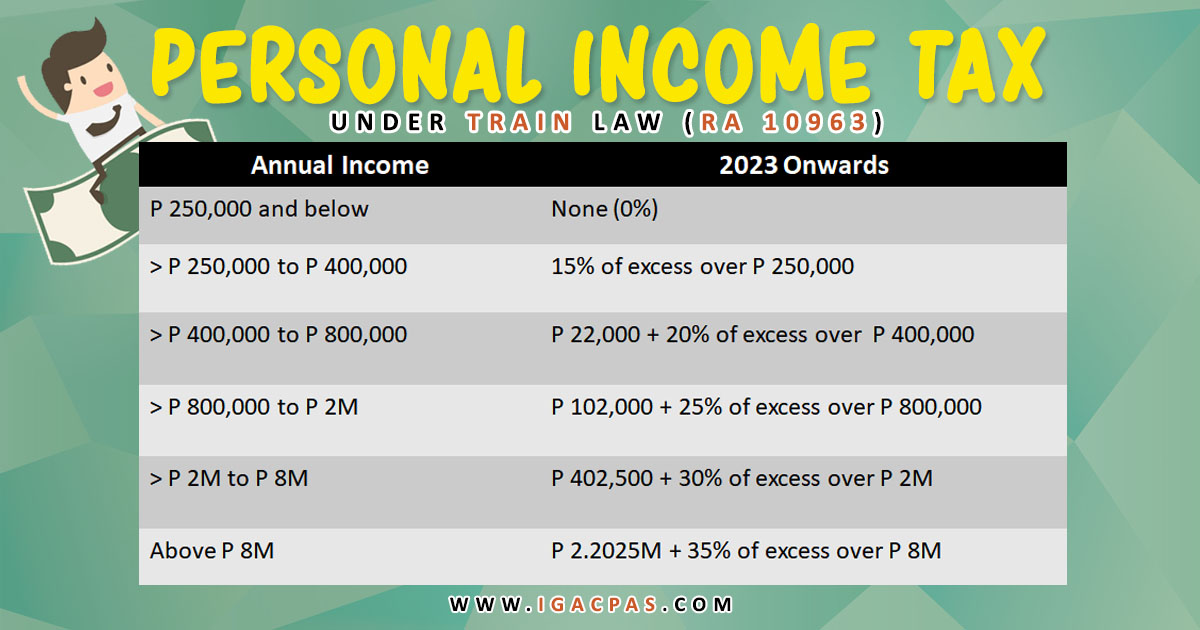

The 2025 tax table in the philippines follows a progressive tax system, which means that the tax rate increases as the taxable income increases.

The calculator is updated with the latest tax rates and brackets as per the 2025 tax year in philippines.